*This is part one of a two-part blog on billionaire philanthropy and the impact on public education

Bill Ackman is an investor, hedge fund manager, and philanthropist. He is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. His current worth is $1.1 billion (Forbes.com).

According to Forbes, Since 2011, Ackman has invested $20 million of his own money in the Turner-Agassi Charter School Facilities Fund, started by former tennis star Andre Agassi.

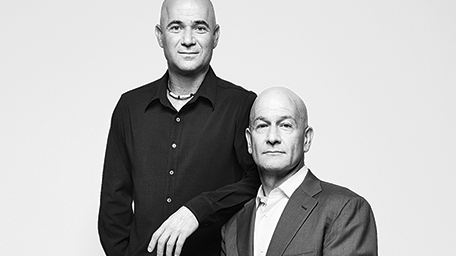

Agassi approached Ackman in 2011 with the Turner-Agassi Charter School Facilities Fund. Agassi, along with Bobby Turner who is the Chairman & Chief Executive Officer, Turner Impact Capital; and subsequently the Co-Managing Partner of the Turner-Agassi Charter School Facilities Fund. Agassi and Turner promised Ackman his capital would “go toward the construction of 100 new charter schools for low-income children by 2020 in areas like the Bronx and Southwest Detroit—and that he would see double-digit returns, to boot” (Forbes.com). The impact investment, which Ackman made via his charitable foundation, has netted annual returns over 10%.

His largest impact investment to date is in the Turner-Agassi Charter School Facilities Fund, which has financed construction for 79 new charter schools that have served over 41,000 students since 2011. It generates returns for investors by leasing or selling new schools to charter school operators like KIPP at a profit. Ackman has put a combined $20 million into two funds. “The impact investment, which Ackman made via his charitable foundation, has netted annual returns north of 10%” (Forbes.com). (Forbes.com).

How do Agassi and his investors make money in charters? It has nothing to do with the schools, their money is in the property. Here’s how it works:

- The Turner-Agassi or The Canyon Agassi Charter School Facilities Fund provides the investment capital to purchase property for the site of a future charter school.

- After buying the real estate, the Agassi group designs and constructs the school building.

- Upon its completion, the Agassi group will retain ownership of the property but the charter school operator will receive a long-term lease with an option to purchase.

- Agassi’s group helps the charter school operator obtain a loan and will even provide bridge financing if necessary.

- The loans are paid with tax dollars earmarked for public schools.

- Agassi’s land investment company is enticing charter school operators into a rent-to-own deal with the tax payers footing the bill (Institutional Investor).

The 2015 Urban Charter School Study Report on 41 Regions from the Center for Research on Education Outcomes at Stanford University found that only 43% of urban charter schools perform better than their peers in math, and 38% in reading. In six regions, including Las Vegas, the overall performance of charter schools is lower than their public school counterparts in either one or both disciplines. Agassi and Turner acknowledge that charter schools aren’t perfect, but they aim to avoid pitfalls by partnering with the best-in-class experts. In response to the Stanford report, Bobby Turner said, “Our job is not to scale mediocrity” (Institutional Investor).

Great investment opportunities, but at what cost? I have blogged about Bill Gates, Reed Hastings, and most recently Jeff Bezos. Agassi now joins the growing list. Why is it bad for public education and for America to allow billionaires with impact investments to “fix” public education? Because it’s unregulated, for profit, and very undemocratic.

DeVos is doing her share, with the support of our government, to spread the dysfunction of charters at the cost of public schools in high poverty areas. DeVos and her husband are on the list of billionaire philanthropists “fixing” public education by de-funding it, and supporting charters. The top 1% should not be making decisions on public issues such as education.

Here’s my idea: why not fund public education, retrain teachers, give ALL schools technological support and training for teachers and students, create internships, apprenticeships, invite scholars to speak to students, fund college scholarships so ALL kids who want to go to college CAN go to college, build new PUBLIC schools, and ensure ALL students have equal access to quality public education. There is a tremendous investment in public education, and the gains are far greater than wealth.

These are my reflections for today.

10/19/18

Follow me on Facebook